Tampons and sanitary pads will remain ‘luxury’ items in Australia, after the Coalition and Labor rejected a Greens Senate move to axe the tax applied to women’s sanitary items.

Unlike products such as condoms and sunscreen, sanitary products attract the 10% goods and services tax (GST) because they are deemed non-essentials.

Non-essentials. Just take a second to let that sink in.

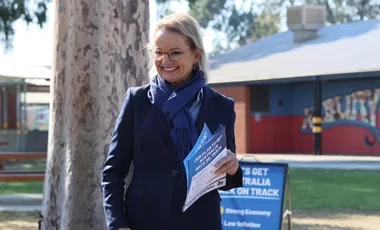

Larissa Waters, Queensland Greens Senator, attempted to scrap the “tampon tax” as a part of an amendment to the government’s legislation which will see the GST added to imported goods worth less than $1000.

However, she was voted down 33 to 15.

As reported on the ABC, Labor has publicly stated its opposition to applying the GST to tampons and sanitary pads, however they feel it should be removed in a different way.

“Exempting sanitary products from the GST needs to be done upfront and transparently with the Commonwealth and states and territories onside,” Senator Katy Gallagher said.

“The fact of the matter is that if the Greens amendment was successful in getting up today it would have sunk the GST Low Value Threshold legislation ensuring that thousands of Australian retailers continue without a level playing field against foreign retailers.”

But Senator Waters argued that women were being taxed “for existing”.

“The costings show the states will not be worse off – in fact they will still be $185 million ahead given the GST bill just passed with the support of Labor and the Coalition – so there is no revenue excuse to keep balancing the budget off the back of women’s biology.”

The tax on sanitary items has been a regular topic of discussion in parliament ever since the products were deemed a non-essential, or luxury item, as part of the Howard government negotiations with the Democrats to get the GST passed.

It’s estimated women annually spend about $300 million on non-essential items, contributing about $30 million to the GST’s bottom line.

And yes, tampons and sanitary pads fall under the “non-essential” umbrella.

RELATED: We Need To Talk About The Tampon Tax

RELATED: You Won’t Believe How Much Money The Government Makes From The Tampon Tax